You are browsing > Service in Taiwan > Development

Trade restrictions among G20 economies remain at historic highsWTO

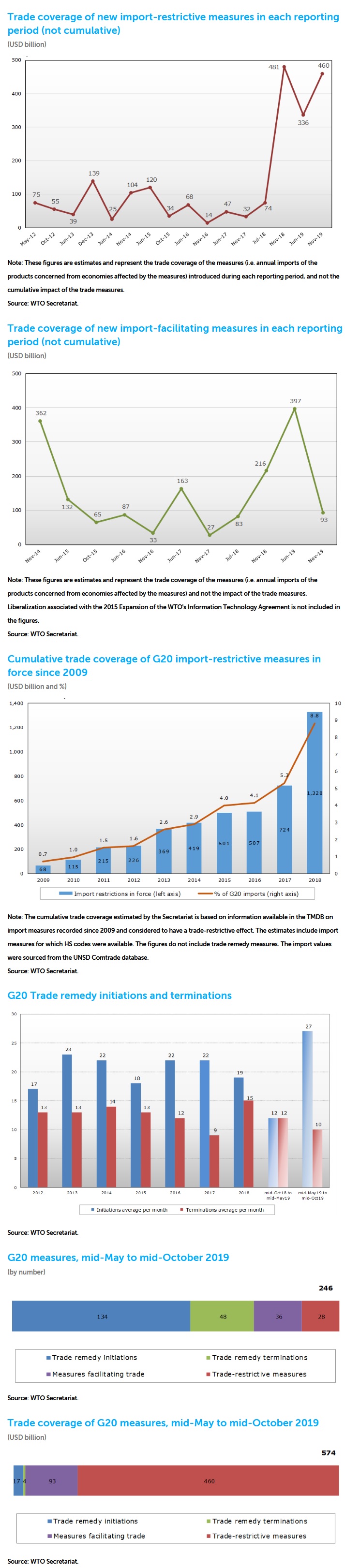

The WTO’s new Trade Monitoring Report issued on 21 November shows that G20 economies from mid-May to mid-October 2019 introduced import-restrictive measures covering an estimated USD 460.4 billion worth of traded merchandise. This represents a 37% increase over the previous period going back to mid-October 2018, and is second only to the USD 480.9 billion coverage of import-restricting measures reported between mid-May and mid-October 2018. The report notes that with restrictions accumulating over time, the share of global trade covered by such measures has soared. WTO Director-General Roberto Azevêdo called on G20 economies to de-escalate trade tensions to spur investment, growth and job creation.

Commenting on the report, Director-General Roberto Azevêdo said:

“The report's findings should be of serious concern for G20 governments and the broader international community. Historically high levels of trade-restrictive measures are having a clear impact on growth, job creation and purchasing power around the world. We need to see strong leadership from G20 economies if we want to avoid increased uncertainty, lower investment and even weaker trade growth.

“We have seen how world trade has stalled during the review period. The WTO downgraded its forecast for merchandise trade growth in 2019 to 1.2%, the slowest since the crisis a decade ago, much lower than April's estimate of 2.6%. New trade restrictions and increasing trade tensions will only add to the uncertainty that is dragging down growth in the world economy. This trend needs to be reversed.”

The report indicates that the slowdown in world trade growth coincided with increasingly negative forward-looking indicators for world trade and output, including export orders derived from purchasing managers' indices as well as measures of economic policy uncertainty. Risks to the forecast are predominantly on the downside and include a further ratcheting-up of trade-restrictive measures and a sharper slowing of GDP growth in one or more major economies.

In terms of numbers, G20 economies implemented 28 new trade-restrictive measures between mid-mid-May and mid-October 2019, mainly tariff increases, import bans and stricter customs procedures for imports. The last three monitoring reports, issued in June 2019, November 2018 and July 2018 have seen the shares of G20 trade covered by new import-restrictive measures fluctuate between approximately 2.5% and 3.5% of imports, compared to significantly smaller proportions previously.

In addition, many import restrictions implemented since 2009 are still in force, resulting in a growing stockpile of measures that in 2018 affected 8.8% of G20 imports (USD 1.3 trillion). The trade coverage of import-restrictive measures in force for the period January–October 2019 is estimated at USD 1.6 trillion, suggesting that import restrictions have continued to grow.

Alongside the trade-restrictive measures, G20 economies also implemented 36 new measures aimed at facilitating trade during the review period, including the elimination or reduction of import tariffs and export duties. The trade coverage of the import-facilitating measures implemented during the most recent review period was estimated at USD 92.6 billion, which is significantly lower than that recorded in the previous report (USD 397.2 billion). Tariff cuts by G20 members associated with the 2015 expansion of the WTO's Information Technology Agreement have in addition covered traded merchandise worth an estimated USD 671 billion during the review period.

During the review period, the monthly average of trade remedy actions initiated by G20 economies was the highest registered since 2012, and more than double the average recorded in the previous G20 Report. Initiations of anti-dumping investigations continue to be the most frequent trade remedy action, accounting for more than four-fifths of all initiations. Meanwhile, the monthly average of trade remedy terminations recorded was the second-lowest since 2012. The trade coverage of trade remedy initiations recorded in this report was estimated at USD 16.7 billion and that of terminations at USD 3.8 billion.

The WTO trade monitoring reports have been prepared by the WTO Secretariat since 2009. G20 members are: Argentina; Australia; Brazil; Canada; China; the European Union; France; Germany; India; Indonesia; Italy; Japan; the Republic of Korea; Mexico; the Russian Federation; the Kingdom of Saudi Arabia; South Africa; Turkey; the United Kingdom; and the United States.

Key findings

This Report covers new trade and trade-related measures implemented by G20 economies between 16 May and 15 October 2019. During the review period, new trade restrictions and increasing trade tensions continued to add to the uncertainty surrounding international trade and the world economy.

World trade growth stalled and the WTO in October downgraded its forecast for world trade growth in 2019 to 1.2%; down from the April estimate of 2.6%. The slowdown coincided with more negative forward-looking indicators for world trade and output, including export orders derived from purchasing managers' indices and economic policy uncertainty based on the frequency of keywords in press accounts. Risks to the forecast are predominantly on the downside and include a further ratcheting-up of trade-restrictive measures and a sharper slowing of GDP growth in one or more major economies.

G20 economies implemented 28 new trade-restrictive measures during the review period. The trade coverage for the new import-restrictive measures implemented by G20 economies was estimated at USD 460.4 billion. This represents an increase of 37% compared to the previous period (USD 335.9 billion) and is only second to the USD 480.9 billion reported for the period mid‑May to mid-October 2018.

The last three Trade Monitoring Reports have seen the shares of G20 trade covered by new import‑restrictive measures fluctuate between approximately 2.5% and 3.5% of G20 imports, compared to significantly smaller shares previously. The trade coverage of import‑restrictive measures over the last three review periods has soared.

The stockpile of import restrictions implemented since 2009, and still in force, suggests that 8.8% of G20 imports are affected by import restrictions implemented since 2009. At the end of 2018, USD 1.3 trillion out of a total USD 15.1 trillion of G20 imports were estimated to be affected by import restrictions put in place by G20 economies over the last decade. The trade coverage of import-restrictive measures in force for the period January to October 2019 is estimated at USD 1.6 trillion, suggesting that import restrictions have continued to grow.

G20 economies also implemented 36 new measures aimed at facilitating trade during the review period. The trade coverage of the new import-facilitating measures implemented by G20 economies was estimated at USD 92.6 billion which is significantly lower than that recorded in the last Report (USD 397.2 billion).

During the review period, the monthly average of initiations of trade remedy actions by G20 economies was the highest registered since 2012, and the monthly average of trade remedy terminations recorded in this Report was the second-lowest since 2012. The trade coverage of trade remedy initiations was estimated at USD 16.7 billion and that of terminations at USD 3.8 billion. Both figures are down from the trade coverage recorded for such measures in the last G20 Report.