You are browsing > Events >

Services trade barometer signals resilience in key sectors amid overall decline2020-09-17

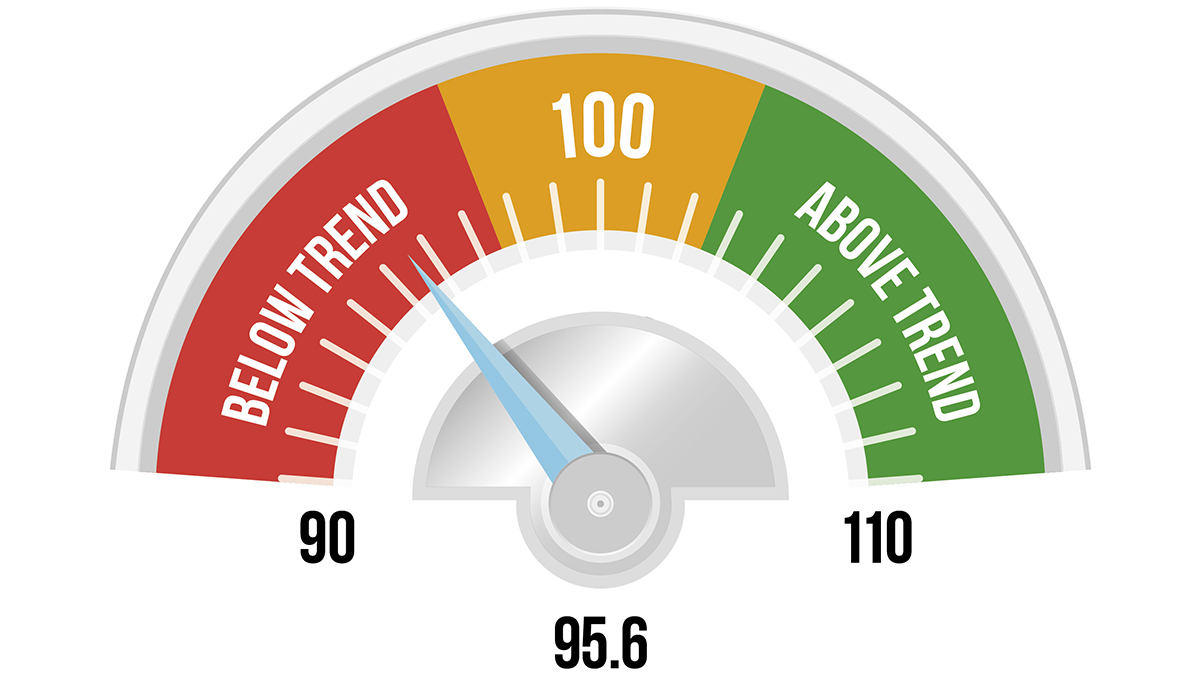

World services trade likely remained far below trend through the second quarter of 2020 amid the economic fallout from COVID-19, but the latest reading from the WTO Services Trade Barometer also shows modest gains in some key sectors, suggesting a degree of resilience in the face of the pandemic. While the 17 September reading of 95.6 is the weakest on record for the index, and significantly lower than its baseline value of 100, the barometer’s measures are in aggregate outperforming recent trends in actual services trade, a gap that in the past has preceded a positive shift in trade momentum.

Most of the barometer's component indices remain below trend but some show signs of bottoming out. Passenger air transport (49.2) has been hardest hit by the pandemic, with the biggest decline ever recorded for any of the barometer's components, reflecting the precipitous drop in travel linked to COVID-19 and efforts to stop its spread. The contraction in this sector has been sufficiently large as to weigh on total global services trade, though it appears to have stabilized recently. Indices representing container shipping (92.4), construction (97.3), and the global services Purchasing Managers' Index (97.0) also show signs of turning around. The upturn in the PMI is noteworthy since it is the most forward-looking component of the services barometer. Meanwhile, the ICT services index tumbled to 94.6 despite robust demand for these services during the pandemic. The financial services index (100.3) was the sole component index that remained on trend as of mid-September.

The services trade activity index, which provides an approximate measure of the volume of world services trade, registered a year-on-year decline of 4.3% in the first quarter of 2020. While substantial, this decline is smaller than those seen during the financial crisis over a decade ago, when services trade fell by 5.1% in the first quarter of 2009 compared to the previous year before registering an even bigger 8.9% slump in the second quarter. Services trade growth had been slowing in the second half of 2019, and the recent contraction in services trade reflects a weakening pace of global economic growth as well as the early stages of the COVID-19 pandemic. While the index is expected to remain below trend into the second half of the year, a recovery in passenger air transport would make a powerful contribution to a turnaround.

The Services Trade Barometer highlights turning points and changing patterns in world services trade. Unlike its counterpart for goods, the fluctuations registered by the services indicator coincide with movements in actual trade flows, rather than anticipating them. Readings of 100 indicate growth in line with medium-term trends. Readings greater than 100 suggest above-trend growth while those below 100 indicate the opposite.

The full Services Trade Barometer is available here.

Further details on the methodology are contained in the technical note here.